QuickLinks-- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| | |

Filed by the Registrantý☒ |

Filed by a Party other than the Registranto☐ |

Check the appropriate box: |

o☐ |

|

Preliminary Proxy Statement |

o☐ |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)14a‑6(e)(2)) |

ý☒ |

|

Definitive Proxy Statement |

o☐ |

|

Definitive Additional Materials |

o☐ |

|

Soliciting Material under §240.14a-12

§240.14a‑12 |

| | | | |

INTERNATIONAL BANCSHARES CORPORATION |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

ý☒ |

|

No fee required. |

o |

|

☐ |

Fee computed on table below per Exchange Act Rules 14a-6(i)14a‑6(i)(1) and 0-11. 0‑11. |

| (1) | (1) | | Title of each class of securities to which transaction applies:

|

| | (2) |

| (2) | Aggregate number of securities to which transaction applies:

|

| | (3) |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-110‑11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | (4) |

| (4) | Proposed maximum aggregate value of transaction:

|

| | (5) |

| (5) | Total fee paid:

|

o |

|

|

☐ | Fee paid previously with preliminary materials. |

o☐ |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)0‑11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

(1) |

(1) |

|

Amount Previously Paid:

|

| | (2) |

| (2) | Form, Schedule or Registration Statement No.:

|

| | (3) | | Filing Party:

|

| (3) | (4)Filing Party: |

| | |

| (4) | Date Filed:

|

| | |

INTERNATIONAL BANCSHARES CORPORATION

1200 San Bernardo Avenue

Laredo, Texas 78040

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 15, 201720, 2019

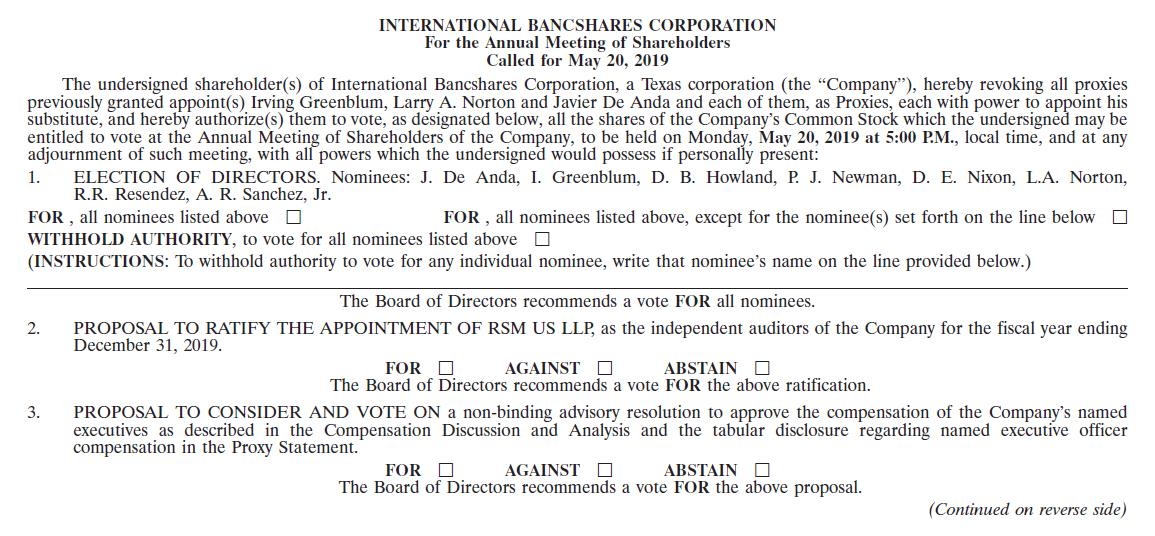

NOTICE IS HEREBY GIVEN that the Annual Meeting of Shareholders of International Bancshares Corporation (the “Company”) will be held atIBC'sIBC’s Annex Building, located at 2416 Jacaman Road, Laredo, Texas 78041, on Monday, May 15, 201720, 2019 at 5:00 p.mp.m.. for the following purposes:

(1)To elect nine (9) directors to serve until the next annual meeting of shareholders and until their successors shall have been duly elected and qualified;

(2)To ratify the appointment of RSM US LLP as independent auditors for the fiscal year ending December 31, 2017;

(3)To consider and approve a non-binding advisory resolution to approve the compensation of the Company's named executives as described in the Compensation, Discussion and Analysis and the tabular disclosure regarding named executive officer compensation in the Proxy Statement;

(4)To reapprove the performance goals included in the 2013 Management Incentive Plan, in accordance with the periodic reapproval requirements of Internal Revenue Code Section 162(m); and

(5)To transact such other business as may lawfully come before the meeting or any adjournment thereof.

| (1) | | To elect eight (8) directors to serve until the next Annual Meeting of Shareholders and until their successors shall have been duly elected and qualified; |

| (2) | | To ratify the appointment of RSM US LLP as independent auditors for the fiscal year ending December 31, 2019; |

| (3) | | To consider and approve a non‑binding advisory resolution to approve the compensation of the Company’s named executive officers as described in the Compensation, Discussion and Analysis and the tabular disclosures in the accompanying Proxy Statement; |

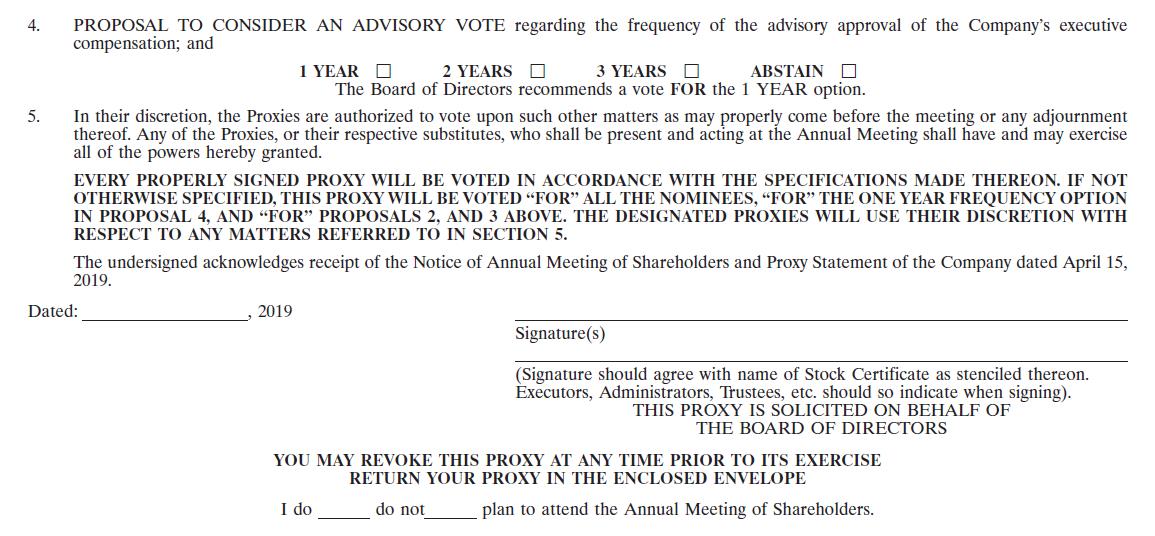

| (4) | | To consider an advisory vote regarding the frequency of the advisory approval of the Company’s executive compensation; and |

| (5) | | To transact such other business as may lawfully come before the meeting or any adjournment thereof. |

Shareholders of record at the close of business on April 3, 20171, 2019 are entitled to notice of and to vote at the Annual Meeting and any postponements or adjournments thereof. The Company's 2016Company’s 2018 Annual Report is being furnished along with this Proxy Statement to the shareholders of record as of April 3, 2017.1, 2019.

Pursuant to rules promulgated by the Securities and Exchange Commission, we have elected to provide access to our proxy materials both by sending you this full set of proxy materials, including a proxy card, and by notifying you of the availability of our proxy materials on the Internet. The enclosed Proxy Statement and Annual Report on Form 10-K10‑K are available on our website atwww.ibc.com, under the heading "Investors"“Investors” in the section for "SEC“SEC Filings."” You may also access our Proxy Statement and Form 10-K10‑K at https://materials.proxyvote.com/459044, which does not have "cookies"“cookies” that identify visitors to the site.

In order to ensure the representation of a quorum at the Annual Meeting, shareholders who do not expect to attend the meeting in person are urged to sign the enclosed proxy card and return it promptly to the Trust Division, International Bank of Commerce, P. O. Drawer 1359, Laredo, Texas 78042-1359.78042‑1359. A return envelope is enclosed for that purpose.

| | |

| | INTERNATIONAL BANCSHARES CORPORATION |

|

|

|

| | Dennis E. Nixon

President and Chairman |

Dated: April 17, 201715, 2019

INTERNATIONAL BANCSHARES CORPORATION

1200 San Bernardo Avenue

Laredo, Texas 78040

PROXY STATEMENT

PROXY STATEMENT

The Board of Directors of International Bancshares Corporation, a Texas corporation, is soliciting proxies to be used at the Annual Meeting of Shareholders to be held on Monday, May 15, 201720, 2019 at 5:00 p.m., local time, at the IBC Annex,located at 2416 Jacaman Rd., Laredo, Texas 78041. The Company will pay for the cost of the proxy material preparation and solicitation, including the reasonable charges and expenses of brokerage firms, banks or other nominees for forwarding proxy materials to street name holders. International Bancshares Corporation is referred to in this document as "we," "us," "our," and“we,” “us,” “our,” or the "Company."“Company.”

It is expected that the solicitation of proxies will be primarily by mail. Proxies may also be solicited personally by regular employees of the Company for no additional compensation. Any shareholder giving a proxy has the power to revoke it at any time prior to the voting of the proxy by giving notice in person or in writing to the Company’s Secretary of the Company at 1200 San Bernardo Avenue, Laredo, Texas 78040, or by appearing at the Annual Meeting, giving notice of revocation of the proxy and voting in person. The approximate date on which this Proxy Statement and the accompanying form of proxy are first sent or given to shareholders is April 17, 2017.15, 2019.

Voting of Proxies and Shares; Quorum

Only the holders of record of outstanding shares of our class of Common Stock, par value $1.00 per share, at the close of business on the record date of April 3, 2017,1, 2019, shall be entitled to notice of and to vote at the Annual Meeting. There were 66,032,68965,644,603 shares of Common Stock issued and outstanding as of that date held by approximately 2,0501,923 shareholders of record. Each such shareholder is entitled to one vote for each share of Common Stock held.

All shares entitled to vote, represented by a properly executed and unrevoked proxy received in time for the Annual Meeting, will be voted in accordance with the instructions given. In the absence of such instructions, shares will be voted as recommended by the Board of Directors. The persons named as proxies will also be authorized to vote in their discretion upon such other matters as may properly come before the Annual Meeting or any adjournment or postponement thereof. If any nominee for director shall be unable to serve, which is not now contemplated, the proxies will be voted for such substitute nominee(s) as the Board of Directors recommends.

If you hold your shares in nominee or street name, a "voting“voting instruction form"form” is the document used to instruct your proxy how to vote your shares. If your shares are held in street name by a broker, the broker will vote your shares only if you give your broker instructions on the "voting“voting instruction form."” If you do not tell your broker how to vote, your broker may vote your shares in favor of ratification of the auditor appointment, but may not vote your shares in favor of the election of directors, the non-bindingnon‑binding advisory resolution to approve the executive compensation program, the proposal regarding the frequency of the advisory approval of the executive compensation program, or any other item of business that is not considered a "routine"“routine” matter. Your broker will return a proxy card without voting on such non-routinenon‑routine matters if you do not give voting instructions with respect to these matters. This is commonly referred to as a "broker non-vote."“broker non‑vote.” We encourage you to vote on all matters proposed in this Proxy Statement.

A quorum for the transaction of business at the Annual Meeting requires representation, in person or by proxy, of the holders of a majority of the issued and outstanding shares of Common Stock. The judges of election will treat abstentions and broker non-votesnon‑votes as shares that are present for purposes of determining the presence of a quorum for the transaction of business at the Annual Meeting. With respect to the election of directors, if a quorum exists, the nominees for director receiving a majority of the votes cast (i.e., the number of shares voted "for"“for” a director nominee exceeds the number of votes cast "against"“against” that nominee) will be elected as directors. Therefore, shares considered not present at the meeting, broker non-votesnon‑votes and shares voting "abstain"“abstain” have no effect on the election of directors. A quorum with respect to

any specific proposal requires representation, in person or by proxy, of the holders of a majority of the issued and outstanding shares of Common Stock entitled to vote on the proposal. If the number of nominees for director exceeds the number of directors to be elected, the directors shall be elected by the vote of a plurality of the shares represented in person or by proxy at the meeting and entitled to vote.

Abstentions will be treated as present and entitled to vote with respect to any proposal for purposes of determining both the presence of a quorum with respect to such proposal and its approval. If a broker indicates on a proxy that it does

not have discretionary authority to vote certain shares on a particular matter, the holder(s) of such shares will not be considered as present with respect to such matter for purposes of determining either the presence of a quorum with respect to such matter or its approval. Thus, abstentions with respect to any such matter will have the same legal effect as a vote against such matter, while broker non-votesnon‑votes will not affect the outcome of such matter.

Annual Meeting Admission

If you wish to attend the Annual Meeting in person, you must present a valid form of photo identification, such as a driver'sdriver’s license. If you are a beneficial owner of Common Stock that is held of record by a bank, broker or other nominee, you will also need proof of ownership to be admitted. In this regard, a recent brokerage statement or a letter from your bank or broker are examples of proof of ownership. The Company reserves the right to prohibit cameras, recording equipment, or electronic devices in the meeting.

Important Notice Regarding Availability of Proxy Materials For

Annual Meeting To Be Held On May 15, 2017

20, 2019

Pursuant to rules promulgated by the Securities and Exchange Commission, we have elected to provide access to our proxy materials both by sending you this full set of proxy materials, including a proxy card, and by notifying you of the availability of our proxy materials on the Internet. This Proxy Statement and our Annual Report on Form 10-K10‑K are available on our website at www.ibc.com, under the heading "Investors"“Investors” in the section for "SEC“SEC Filings."” To protect your privacy, you may also access our Proxy Statement and Form 10-K10‑K at https://materials.proxyvote.com/459044, which does not have "cookies"“cookies” that identify visitors to the site.

PROPOSAL—1

ELECTION OF DIRECTORS

Directors are elected at each annual meeting of shareholdersannually and hold office until their respective successors are duly elected and qualified. Each nominee currently serves as a director of the Company. It is the intention of the persons named in the enclosed form of proxy, unless the proxy specifies otherwise, to vote the shares represented by the proxyFOR the election of the nominees set forth below. Although it is anticipated that each nominee will be available to serve as a director, should any nominee become unavailable to serve, the proxies will be voted for such other person as may be designated by the Board of Directors.

Certain information concerning each nominee as of April 3, 20171, 2019 is set forth below, and in some cases includes information pertaining to service with International Bank of Commerce, or IBC, the Company'sCompany’s lead bank subsidiary and predecessor company.

| | | | | | |

| | Director | | | | |

Nominee For Director | | Since | | Age | | Company Position(s) |

Javier de Anda | | 2015 | | 66 | | Director(1) |

Irving Greenblum | | 1981 | | 89 | | Director(2)(3) |

Douglas B. Howland | | 2010 | | 68 | | Director(1)(2)(3) |

Peggy J. Newman | | 1997 | | 87 | | Director(3) |

Dennis E. Nixon* | | 1975 | | 76 | | Chairman of the Board and President; IBC Chief Executive Officer; Director |

Larry A. Norton | | 2010 | | 71 | | Director(1)(2)(3) |

Roberto R. Reséndez | | 2015 | | 68 | | Director(1) |

Antonio R. Sanchez, Jr. | | 1995 | | 76 | | Director |

| | | | | | | | |

Nominee For Director | | Director

Since | | Age | | Company Position(s) |

|---|

Javier de Anda | | | 2015 | | | 64 | | Director(1) |

Irving Greenblum | | | 1981 | | | 87 | | Director(1)(2)(3) |

Douglas B. Howland | | | 2010 | | | 66 | | Director(1)(2)(3) |

Peggy J. Newman | | | 1997 | | | 85 | | Director(3) |

Dennis E. Nixon* | | | 1975 | | | 74 | | Chairman of the Board and President; IBC Chief Executive Officer; Director |

Larry A. Norton | | | 2010 | | | 69 | | Director(1)(2)(3) |

Roberto R. Reséndez | | | 2015 | | | 66 | | Director |

Leonardo Salinas | | | 1976 | | | 83 | | Director(1) |

Antonio R. Sanchez, Jr. | | | 1995 | | | 74 | | Director |

*

- Executive Officer of the Company

(1)Member of the Audit Committee

(2)Member of the Nominating Committee

(3)Member of the Compensation Committee

| (1) | | Member of the Audit Committee |

| (2) | | Member of the Nominating Committee |

| (3) | | Member of the Compensation Committee |

The business experience for the past five years of each of the director nominees is set forth below, and includes information regarding the person'sperson’s experience, qualifications, attributes or skills that led the Nominating Committee and the Board of Directors to the conclusion that the person should serve as a director for the Company. Each director nominee other than Mr. Sanchez is also a director of IBC. None of the director nominees nor executive officers of the Company havehas a family relationship with any of the other nominees or executive officers, except for Mr. de Anda who is Mrs. Newman's son-in-law.Ms. Newman’s son‑in‑law.

Javier de Anda joined our Board of Directors in September 2015 and the board of IBC Laredo in July 2015. Mr. de Anda is a Laredo native and has been a member of the board of IBC'sIBC’s subsidiary bank, Commerce Bank, since March 2010. He currently serves as the Senior Vice-PresidentVice‑President of B.P. Newman Investment Co., a private real estate company and apartment building operator founded in 1968 in Laredo, andLaredo. Mr. de Anda also currently co-ownsco‑owns 20 Popeye'sPopeye’s Louisiana Kitchen franchises in the Laredo and El Paso area, which employs more than 300 people. His achievements led to his induction into the Laredo Junior Achievement Business Hall of Fame. Mr. de Anda'sAnda’s extensive ties to local community and business leaders, demonstrated leadership skills, entrepreneurial business experience and his significant knowledge of the markets that we serve, as well as his long-standinglong‑standing service as a director for Commerce Bank, have led the Board to conclude that he should continue serving on our Board.

Irving Greenblum has been one of our directors since 1981, and a director of IBC for the same period. Mr. Greenblum is a private investor and has been involved in international opportunities and real estate investments in the Laredo business community for over fifty years. In addition to his demonstrated leadership skills, his business experience, his long-standinglong‑standing service to the Company and very active role as a director of the Company, as well as his knowledge of the Texas communities we serve; have led the Board to conclude that Mr. Greenblum should continue serving on our Board.

Douglas B. Howland has been a director of ours since 2010, and has served on the board of our subsidiary bank, Commerce Bank for over twenty years before becoming one of our directors. Mr. Howland served as the chief executive officer of Libcon, Inc., a privately-heldprivately‑held construction company in Laredo until its sale April 2011, and as a private investor since that time. He has served as director of the Laredo Development Foundation for more than 15 years and continues to be an active member of the Laredo business and non-profit

non‑profit communities. Mr. Howland has a bachelorBachelor of scienceScience degree in civil engineering from Texas A&M University. In addition to his role as one of our independent directors, Mr. Howland'sHowland’s experiences in preparing, analyzing or evaluating financial statements, as well as his experience in business operations and management and knowledge of the Texas communities we serve, have led the Board to conclude that Mr. Howland should continue serving on our Board.

Peggy J. Newman has been one of our directors, since 1997, and a director of IBC since 1997. Ms. Newman has been a private real estate investor through various entities. She is currently and has been president of B.P. Newman Investment Co., Inc. located in Laredo, Texas for more than five years. Ms. Newman'sNewman’s experience in preparing, analyzing and evaluating financial statements, her experience in business operations and management, her long service to the Company and very active role as a director of the Company, and her knowledge of the Texas communities we serve, have led the Board to conclude that Ms. Newman should continue serving on our Board.

Dennis E. Nixon has served as the Company’s chairman and president since 1979. Prior thereto, he served IBC as its chief executive officer since 1975, and was alsoas president of IBC during that same period until September 2015. Mr. Nixon has also served as the Company's chairman and president since 1979.period. With over 4043 years of experience working in the banking industry in Texas and serving as our chief executive officer for most of that time, Mr. Nixon bringsNixon’s outstanding leadership skills and a deep understanding of the local banking market and issues facing the banking industry, as well as his knowledge of the communities we serve, thathas led the Board to conclude that Mr. Nixon should continue serving on our Board.

Larry A. Norton has been one of our independent directors and a director of IBC since 2010, and2010. In addition, he served on the board of our subsidiary Commerce Bank for over twenty-fivetwenty‑five years. He has been the Presidentpresident of Norton Stores Inc., a family retail sales business, until his retirement as of December 31, 2016, and owner of Larry A. Norton & Co., a retail computer sales company, for more than thirty years. He has served as president of the Laredo Chamber of Commerce with close ties to the Laredo business and non-profitnon‑profit communities. In addition to his experience reviewing financial statements and financial matters, Mr. Norton'sNorton’s experiences in business operations and management, as well as his knowledge of the Texas communities that we serve, have led the Board to conclude that Mr. Norton should continue serving on our Board.

Roberto R. Reséndez was appointed to our Board in July 2015. Mr. Reséndez has more than thirty years'years’ experience as an ownerin ranching and operator of a ranching operation in Mexico.investments. Mr. Reséndez has a bachelorBachelor of scienceScience degree in industrial engineering from Texas A&M University. He also has real estate holdings and investments in Laredo and Mexico. As one of our independent directors, Mr. Reséndez has thendez’s leadership skills and experience in reviewing financial statements and financial matters that has led the Board to conclude that he should continue serving on our Board.

Leonardo Salinas has been a director since 1976 and served as vice president of the Company and senior executive vice president of IBC until his retirement in 2000. Mr. Salinas is one of our independent directors and is involved in real estate investments in Laredo. In addition to his experience in the banking and financial services industry, his long-standing service as a director and former officer of the Company, as well as his knowledge of the communities we serve, that led the Board to conclude that Mr. Salinas should continue serving on our Board.

Antonio R. Sanchez, Jr. has been a director of the Company since 1995,1995. He has been an independent oil and gas operator since 1973, and has been an owner, director since 1979 and the Chairman of the Board of Sanchez Oil & Gas Corporation since 1992. Also, since 2012, Mr. Sanchez, Jr. has been a director and the Chairman of the Board of Sanchez Energy Corporation (NYSE: SN), an independent, publicly-tradedpublicly‑traded oil and natural gas exploration and production company. Mr. Sanchez'sSanchez’s long tenure as a successful businessman, his public company leadership experience, his long-standinglong‑standing service as a director of the Company, as well as his strong ties to and knowledge of the Texas communities we serve, have led the Board to conclude that Mr. Sanchez should continue serving on our Board.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE "“FOR"” EACH NAMED NOMINEE.

If a quorum exists, the nominees for director receiving a majority of the votes cast (i.e., the number of shares voted "for"“for” a director nominee exceeds the number of votes cast "against"“against” that nominee), will be elected as directors. Votes cast will include only votes cast with respect to shares present in person or represented by proxy at the meeting and entitled to vote and will exclude abstentions. Therefore, shares not considered present, at the meeting, broker non-votesnon‑votes and shares voting "abstain"“abstain” will have no effect on the election of directors.

CORPORATE GOVERNANCE

The Company isWe are committed to sound corporate governance practices. The Board of Directors has implemented a number of enhancements to our corporate governance practices, including adopting a majority vote standard for uncontested director elections. The Board also formed a Risk Committee and adopted a written Risk Committee Charter. The Board also formed a Nominating Committee of independent directors to identify qualified candidates for nomination to the Board, as discussed further below.

Our Common Stock is listed on the Nasdaq Global Select Market, which listing rules require that a majority of our directors be "independent“independent directors,"” as defined in the Nasdaq Marketplace Rules. TheOur Board has affirmatively determined that all of the Company'sCompany’s directors, other than Messrs. Nixon and Sanchez, are independent directors under the Nasdaq listing rules.

During 2016,2018, the Board of Directors held six meetings. All of the directors attended at least 75% of the aggregate of the total number of meetings of the Board and the total number of meetings held by all committees of the Board on which such director served.served, except for Ms. Newman who attended approximately 33% of such meetings. The Board also took action on a number of occasions as needed without a physical meeting in the form of unanimous written consents. In addition, non-employeenon‑employee directors meet periodically in executive session without members of management present. The non-employeenon‑employee directors met in executive session six times during 2016.2018.

The Board of Directors has established a Nominating Committee, which operates under a formal written charter adopted by the Board. The Nominating Committee recommended each of the current director nominees, which recommendation wasrecommendations were subsequently confirmed by the Board of Directors. The Nominating Committee Charter is available on the Company'sCompany’s website at www.ibc.com. under the heading "Investors-Corporate“Investors—Corporate Governance."”

The Nominating Committee is comprised of three directors, as determined by the Board, each of whom satisfies the independence requirements of the Nasdaq Marketplace Rules, and has experience that, in the business judgment of the Board, would be helpful in addressing the matters delegated to the Committee. The independent directors utilize a variety

of methods for identifying and evaluating director nominees. The Nominating Committee Charter sets forth criteria that the Committee may consider, among other criteria deemed appropriate by the Committee, in recommending candidates for election to the Board. The Board has no formal policy regarding diversity, but diversity is considered when evaluating nominees because the Board believes it is beneficial to the Company for directors to reflect the diversity of the Company'sCompany’s markets. The Company also does not have formal stock ownership guidelines for directors, but ownership of our Common Stock by a director candidate is a factor that was considered by the

Nominating Committee in connection with its recommendation of the existing directors for an additional term.

The Nominating Committee will consider director candidates recommended by shareholders if provided with the following: (i) evidence, in accordance with Rule 14a-814a‑8 under the Exchange Act, of compliance with shareholder eligibility requirements; (ii) the written consent of the candidate(s) for nomination as a director and verification as to the accuracy of the biographical and other information submitted in support of the candidate; (iii) a resume or other written statement of the qualifications of the candidate(s) for nomination as a director; and (iv) all information regarding the candidate(s) and the submitting shareholder that would be required to be disclosed in a proxy statement filed with the SEC if the candidate(s) were nominated for election to the Board of Directors. Any recommendations received from shareholders will be evaluated in the same manner that other potential nominees are evaluated. Any shareholder that wishes to present a director candidate for consideration should submit the information identified above pursuant to the procedures set forth below under "Shareholder“Shareholder Communication with the Board of Directors."” With respect to the timing of shareholder nominations for the 20182020 Annual Meeting, please see the discussion set forth below under "Shareholder“Shareholder Proposals For 20182020 Annual Meeting."” The Company received no nominations of board candidates from our shareholders for the Annual Meeting.

Although the Company does not have a formal policy regarding director attendance at annual shareholder meetings, directors are expected to attend these meetings absent extenuating circumstances. All of our then current directors were in attendance at last year'syear’s annual shareholder meeting.meeting, except for Antonio R. Sanchez, Jr.

The Board of Directors has adopted the International Bancshares Corporation Code of Ethics and Conflicts of Interest Policy,Business Conduct, which is available on the Company'sCompany’s website at www.ibc.com. The Code of Ethics and Conflicts of Interest PolicyBusiness Conduct applies to all directors, officers and employees of the Company. Certain sections of the PolicyCode only apply to financial professionals of the Company. Any amendment to, or any waiver applicable to any of our directors, executive officers or senior financial officers of, the Code of Ethics and Conflicts of Interest PolicyBusiness Conduct will be disclosed on our website within the time period required by the SEC and the Nasdaq Global Select Market.

Shareholders may communicate directly with the Board of Directors. All communications should be in writing and directed to the Company'sCompany’s Corporate Secretary, Marisa V. Santos, at International Bancshares Corporation, P. O. Drawer 1359, Laredo, Texas 78042, and should prominently indicate on the outside of the envelope that it is intended for the Board of Directors. The Corporate Secretary has the authority to disregard any inappropriate communications or to take other appropriate actions with respect to any such inappropriate communications. If deemed appropriate, the Corporate Secretary will forward correspondence to the Chairman of the Board or any specific director or Committee to whom the correspondence is directed. In general, communications relating to corporate governance and long-termlong‑term corporate strategy are more likely to be forwarded than communications relating to ordinary business affairs, personal grievances and matters as to which the Company tends to receive repetitive or duplicative communications. Also, pursuant to our restated Bylaws, a special meeting of shareholders shall be called by the Chairman of the Board, President or Secretary of the Company whenever shareholders holding at least fifty percent (50%) of all the shares entitled to vote at the proposed special meeting make application therefore in writing, which request must state a proper purpose for the meeting and shall be delivered to the Chairman of the Board or the President.

Pursuant to our Bylaws, the president is the Company'sCompany’s chief executive officer, or CEO. The Bylaws also provide that the Board of Directors appoint one of its members to be its Chairman, which is not considered to be an officer position

of the Company. The Board does not have a policy on whether the role of Chairman and CEO should be separate or combined, but currently believes that the most effective leadership structure for the Company is to combine these responsibilities. The structure avoids duplication of efforts that can result from the roles being separated and avoids confusion within and outside of the Company with respect to who is the highest rankedranking officer of the Company. The Board also believes that combining these roles enhances accountability for the Company'sCompany’s performance by avoiding confusion about who is the highest rankedranking officer. Furthermore, as the Company has combined these roles for almost twenty years, separating them could cause significant disruption in oversight and lines of reporting. Nevertheless, depending upon the circumstances, the Board could choose to separate the roles of Chairman and CEO in the future.

The Company does not have a designated lead independent director. In this regard, the Board of Directors believes that the composition of the Board and the very active involvement by the independent directors create a Board culture that is effective and promotes the consideration of the varied views of all of the directors of the Company. SevenSix of the nineeight directors of the Company are "independent"“independent” as defined in the applicable Nasdaq Marketplace Rules. Further, to help ensure oversight by our independent directors, our Audit, Compensation, Stock Option, Nominating and Long-TermLong‑Term Restricted Stock Unit Committees are all composed only of independent directors. In addition, the Board does not limit the tenure of its directors, but considers the tenure of the director and the level of involvement of the director on the Board, along with all the other attributes and qualities of the director, in determining whether to approve a director as a nominee for election as a director.

The Company has a succession plan for its CEO, as well as the chief executive officers of the twelve banking centers of the Company. The succession plan focuses on an internal growth strategy. The Company has developed a management structure that emphasizes development from within, but also allows for the addition of qualified leadership from outside the Company when the circumstances warrant such action. The Company'sCompany’s decentralized operating platform enables the Company to grow and mature its executive management team. There are a number of banking center chief executive officers that have served in such capacity for over twenty years. It is contemplated that the Board, with the advice and counsel of Mr. Nixon, the current long-standing CEO, will at the timewhen deemed appropriate by the Board, select a new CEO by choosing one of the banking center CEOs; although the succession plan would allow the Board to recruit a new CEO if it so chooses.

The Board of Directors is actively involved in overseeing risk management for the Company. The Company'sCompany’s senior risk officers provide a comprehensive risk report to the Board. The Board also engages in periodic risk management discussions with the senior risk officers, CEO, chief financialaccounting officer and other Company officers as the Board may deem appropriate. All of the directors of the Company, except for Mr. Sanchez, are also directors of IBC, which represents over a majority of the Company'sCompany’s banking assets. As such, the Board also receives regular reports on risk management matters of IBC.

The Board of Directors also established a Risk Committee and adopted a written Risk Committee Charter. The Risk Committee is appointed by the Board to assist the Board in fulfilling its oversight responsibilities with regard to the Company'sCompany’s risk management. The Chair of the Risk Committee must be "independent,"“independent,” as defined in the Nasdaq Marketplace Rules. Currently, all of the members of the Risk Committee are independent directors. In addition, each other committee of the Board has been assigned oversight responsibility for specific areas of risk. For example, the Compensation Committee considers risks that may result from changes in the Company'sCompany’s compensation programs, while the Asset/Liability,

Investment, Balance Sheet-Management,Sheet‑Management, Funds Management/Liquidity Interest Rate Risk Committee focuses on risk related to credit and interest rates, among others. The Audit Committee reviews risk related to our financial reporting.

Our senior risk officers report directly to the Board of Directors and to the CEO for administrative purposes. The Board believes that the combination of the joint CEO and Chairman positions and the roles of the Board and its committees provide the appropriate leadership to help ensure effective risk oversight.

At December 31, 2016,2018, the Board of Directors had eight active committees: Audit Committee; Compensation Committee; Nominating Committee; Stock Option Plan Committee; Asset/Liability, Investment, Balance Sheet-Management,Sheet‑Management, Funds Management/Liquidity Interest Rate Risk Committee; Long-TermLong‑Term Restricted Stock Unit Plan Committee; Profit Sharing Plan Committee; and Risk Committee.

Audit Committee

TheDuring 2018, the Audit Committee of the Board of Directors during 2016 consisted of Irving Greenblum, Leonardo Salinas,Roberto Reséndez, Douglas B. Howland, Larry A. Norton and Javier de Anda who was appointed in May of 2016.Anda. The Audit Committee met sixseven times during the 2016 fiscal year.2018. The Audit Committee oversees the accounting and financial reporting of the Company and its primary functions are to recommend the appointment of the independent auditors; to review annual and quarterly financial reports; and to review the results of audits by the internal auditor and the independent auditors. Under applicable law, theThe Audit Committee is required to review with management and the independent auditors the basis for all financial reports. The Board of Directors has adopted a separate Audit Committee Charter. The charter for the Audit CommitteeCharter, which is available on the Company'sCompany’s website at www.ibc.com under the heading "Investors—“Investors—Corporate Governance."”

The Board of Directors has determined that Douglas B. Howland is an "audit“audit committee financial expert"expert” as defined by the SEC regulations due to the relevantbased on his significant experience he has gained from serving as the chief executive officer of Libcon, Inc. for over twenty years, serving on the Audit Committee of the Company for over sixeight years, and serving as the Chairman of the Audit Committee for almost fourover five years. All Audit Committee members are "independent"“independent” as defined in the applicable Nasdaq Marketplace Rules, and each has been selected for the Audit Committee by the Board based on the Board'sBoard’s determination that they are fully qualified to (i) review and understand the Company'sCompany’s financial statements, (ii) monitor the performance of management, (iii) monitor the Company'sCompany’s internal accounting operations, (iv) monitor the independent auditors, and (v) monitor the disclosures of the Company to the end that they fairly present the Company'sCompany’s financial condition and results of operations. In addition, the Audit Committee has the authority on its own to retain independent accountants or other consultants or experts whenever it deems appropriate; although it did not exercise that authority during 2016.2018.

As of December 31, 2016,2018, management assessed the effectiveness of the design and operation of the Company'sCompany’s internal controls over financial reporting based on the criteria for effective internal control over financial reporting established in "Internal“Internal Control—Integrated Framework,"” issued by the Committee of Sponsoring Organizations (COSO) of the Treadway Commission in 2013. Based on that assessment, management determined that the Company maintained effective internal control over financial reporting as of December 31, 2016,2018, based on those criteria.

During 2016,2018, the Long-TermLong‑Term Restricted Stock Unit Plan Committee consisted of Irving Greenblum, Peggy J. Newman and Larry A. Norton. The Long-TermLong‑Term Restricted Stock Unit Plan Committee did not meet during the 20162018 fiscal year. Its primary function is the administration of the 2009 International Bancshares Corporation Long-TermLong‑Term Restricted Stock Unit Plan, which includes determining the form,

terms, conditions and amount of each grant under such Plan. The Long-TermLong‑Term Restricted Stock Unit Plan Committee has the authority to retain outside consultants or separate legal counsel, which authority it did not exercise during 2016.2018. Each member of the Long-TermLong‑Term Restricted Stock Unit Plan Committee is "independent"“independent”, as defined in applicable Nasdaq Marketplace Rules. The Long-TermLong‑Term Restricted Stock Unit Plan was adopted while the Company was a participant under the TARP program. The Company exited the TARP program in 2012 and the Company has not granted for several years, and does not intend to grant, any additional Long-TermLong‑Term Restricted Stock Units during this fiscal year or in the foreseeable future.

Asset/Liability, Investment, Balance Sheet-Management,Sheet Management, Funds Management/Liquidity Interest Rate Risk Committee

The Asset/Liability, Investment, Balance Sheet-Management,Sheet‑Management, Funds Management/Liquidity Interest Rate Risk Committee consisted of Dennis E. Nixon, Irving Greenblum, R. David Guerra, Douglas B. Howland, Larry A. Norton and Roberto Resendez who was appointed in May of 2016.R. Reséndez. The Committee met twice in 20162018 and all of its members were present at such meetings except for Mr. Norton who missed one of the meetings. The Committee’s primary function of the Asset/Liability, Investment, Balance Sheet-Management, Funds Management/Liquidity Interest Rate Risk Committee is to administer the investment activity of the Company, including the review of regulatory compliance.

During 2016,2018, the Profit Sharing Plan Committee consisted of Irving Greenblum, Peggy J. Newman, Dennis E. Nixon and Larry A. Norton. The Company has a deferred profit sharing plan for eligible employees. The Profit Sharing Plan Committee met oncetwice during 20162018 and all of its members were present. The primary function of the Profit Sharing Plan Committee is to administer the Employee'sEmployees’ Profit Sharing Plan.

Risk Committee

The primary function of the Risk Committee is to assist the Board in fulfilling its oversight responsibilities with regard to the Company'sCompany’s risk structure and risk management, and overseeing policies relating to the Company'sCompany’s risk management and its compliance with regulatory obligations. During 2016,2018, the Risk Committee consisted of Irving Greenblum, Douglas B. Howland, Larry A. Norton, Dennis E. Nixon and Roberto Resendez who was appointed in May 2016.R. Reséndez. The Risk Committee met eightfour times during 20162018 and all of its members were present at each.each meeting. The Risk Committee Charter is posted on the Company'sCompany’s website at www.ibc.com under the heading "Investors—“Investors—Corporate Governance."”

The Nominating Committee consists of Irving Greenblum, Douglas B. Howland Irving Greenblum, and Larry A. Norton. The Committee met twiceonce during 2016 with2018 and all of its members present at the meetings.were present. The primary function of the Nominating Committee is to identify and recommend qualified candidates to become Board members. Also, the Nominating Committee shall, at least annually, review the Board'sBoard’s annual review of its performance and consider the results of such evaluation when determining whether or not to recommend the nomination of existing directors for an additional term.

During 2016,2018, the Stock Option Plan Committee consisted of Irving Greenblum, Peggy J. Newman and Larry A. Norton. The Stock Option Plan Committee met three timestwice during 20162018 and all members of the committeeits members were present at such meetings. The Stock Option Plan Committee'sCommittee’s primary function is the administration of the 2012 International Bancshares Corporation Stock Option Plan, which includes taking all final action on the amount, timing, price and other terms of all options granted under such Plan. The

Stock Option Plan Committee has the authority to retain outside consultants or separate legal counsel, which authority it did not exercise during 2016.2018. Each member of the Stock Option Plan Committee that served during 20162018 and who is serving in 20172019 is independent as defined in applicable Nasdaq Marketplace Rules.

Since all cash compensation paid to our executive officers of the Company is paid by the Company's lead bank subsidiary, IBC, the IBC Salary and Steering Committee of IBC's Board of Directors is responsible for making recommendations to the IBC Board of Directors regarding each executive officer'sofficer’s cash compensation. Each member of the Compensation Committee is also a member of the IBC Salary and Steering Committee, of IBC, and an independent director, as defined in the applicable Nasdaq Marketplace Rules. The Compensation Committee has the authority to retain outside consultants or separate legal counsel, which authority the Compensation Committee did not exercise during 2016.2018. The Compensation Committee during 20162018 consisted of Irving Greenblum, Douglas B. Howland, Jr., Peggy Newman and Larry Norton. The Compensation Committee met twiceonce during the 2016 fiscal year2018, with all members attending each of such meetings.meeting. The Board of Directors adopted a written Compensation Committee Charter that is posted on the Company'sCompany’s website at www.ibc.com under the heading "Investors—“Investors—Corporate Governance."”

None of the members of the Compensation Committee or the Stock Option Plan Committee was an officer or employee of the Company or any of its subsidiaries in 2016,2018, nor was any member formerly an officer or employee of the Company or any of its subsidiaries. Some of the members of the Compensation Committee, and some of these members'members’ associates, are current or past customers of one or more of the Company'sCompany’s subsidiary banks. Since January 1, 2016,2018, no transactions between these persons and such subsidiaries have occurred, other than borrowings. In the opinion of management, all of the borrowings have been in the ordinary course of business, have had substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable transactions with other persons and did not involve more than the normal risk of collectability. Additional transactions may take place in the future.

DIRECTOR COMPENSATION

The table below summarizes the compensation we paid by the Company to our non-employeenon‑employee directors for the year ended December 31, 2016.2018.

| | | | | | |

| | Fees Earned | | | | |

| | or Paid in | | All Other | | |

Name | | Cash ($)(1) | | Compensation ($)2) | | Total ($) |

Javier De Anda | | 7,000 | | 16,000 | | 23,000 |

Irving Greenblum | | 8,100 | | 16,400 | | 24,500 |

Douglas B. Howland | | 9,400 | | 18,800 | | 28,200 |

Peggy J. Newman | | 1,700 | | 15,400 | | 17,100 |

Larry A. Norton | | 9,700 | | 17,800 | | 27,500 |

Roberto R. Reséndez | | 9,400 | | 17,000 | | 26,400 |

Antonio R. Sanchez, Jr. | | 5,000 | | 6,000 | | 11,000 |

| | | | | | | | | | |

Name | | Fees Earned

or Paid in

Cash ($)(1) | | All Other

Compensation ($)(2) | | Total ($) | |

|---|

Javier De Anda | | | 5,100 | | | 15,800 | | | 20,900 | |

Irving Greenblum | | | 9,900 | | | 16,100 | | | 26,000 | |

Douglas B. Howland | | | 9,900 | | | 17,900 | | | 27,800 | |

Peggy J. Newman | | | 5,700 | | | 15,800 | | | 21,500 | |

Larry A. Norton | | | 8,400 | | | 17,300 | | | 25,700 | |

Roberto R. Reséndez | | | 6,300 | | | 15,800 | | | 22,100 | |

Leonardo Salinas | | | 7,500 | | | 17,000 | | | 24,500 | |

Antonio R. Sanchez, Jr. | | | 3,600 | | | 5,000 | | | 8,600 | |

(1)Each director receives compensation for his or her services as a director of the Company in the amount of $900 for each board meeting and $300 for each meeting of a board committee that the director attends.

(2)Includes amounts paid to certain directors for their services as a director of a subsidiary bank in the amount of $900 for each board meeting and $300 for each meeting of a board committee of the subsidiary bank that the director attends, as well as an additional year-end payment of $5,000. All directors received certain perquisites from the Company during 2016, but the incremental cost of providing those perquisites was significantly less than the $10,000 disclosure threshold per director.

| (1) | | Each director receives compensation for his or her services as a director of the Company in the amount of $1,000 for each board meeting and $400 for each meeting of a board committee that the director attends. |

| (2) | | Includes amounts paid to certain directors for their services as a director of a subsidiary bank in the amount of $1,000 for each board meeting and $400 for each meeting of a board committee of the subsidiary bank that the director attends, as well as an additional year‑end payment of $5,000. All directors received certain perquisites from the Company during 2018, but the incremental cost of providing those perquisites was significantly less than the $10,000 disclosure threshold per director. |

Some Board meetings were conducted by telephone conference where directors do not receive a fee for attending. Salaried officers of the Company who are directors are not compensated for committee meetings. No stock options, equity-basedequity‑based awards, or other forms of non-equitynon‑equity incentive plan compensation are granted to non-employeenon‑employee board members. The director fees paid to the named executive officers by the Company and the subsidiary banks are included in the "All“All Other Compensation"Compensation” column set forth in the "Summary“Summary Compensation Table"Table” below.

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

The Compensation Committee Charter is posted on the Company's website at www.ibc.com under the heading "Investors—Corporate Governance." The Compensation Committee's primary duties and responsibilities are to:

•Review and approve corporate goals and objectives relevant to compensation of the Company's Chief Executive Officer, evaluate the CEO's performance in light of those goals and objectives, and make recommendations to the Board with respect to the CEO's compensation based on such evaluation;

•Make recommendations to the Board with respect to incentive compensation and equity-based compensation plans that are subject to Board approval;

•Review and discuss with the Company's management theIn this Compensation Discussion and Analysis or CD&A, to be included in the Company's Proxy Statement or the Company's Annual Report on

Management Incentive Plan. During 2013, the Company adopted the International Bancshares Corporation Management Incentive Plan, or MIP, which provides non-equity incentive compensation and is administered by the Compensation Committee. The MIP provides that the Compensation Committee shall establish performance goals and targets that must be satisfied prior to paying an incentive payment under the MIP. On February 27, 2017, the Compensation Committee certified in writing that the performance targets for fiscal year ending December 31, 2016 were met and exceeded by the Company and on February 27, 2017, the Compensation Committee approved an award of $1,000,000 be paid to Dennis E. Nixon, President of the Company, under the MIP for services rendered during fiscal year 2016. The Compensation Committee believes its decision to make an award to Mr. Nixon under the MIP for services rendered in fiscal year 2016 is consistent with the compensation objectives of the MIP.

Review Say on Pay Vote. The Compensation Committee Charter states that the Compensation Committee shall review the results of any advisory shareholder vote on executive compensation required by the SEC rules and consider whether to recommend adjustments to the Company's executive compensation policies and practices. At the 2016 Annual Meeting, the non-binding advisory vote on the compensation of the Company's named executive officers as described in the Proxy Statement for that year received the affirmative vote of the holders of more than a majority of shares of Common Stock represented in person or by proxy, at the meeting and entitled to vote on the proposal. The Compensation Committee considered the favorable results of the advisory shareholder vote and did not recommend any adjustments to the Company's executive compensation policies or practices as a result of such advisory shareholder vote.

The Compensation Committee has reviewed and discussed with management the Compensation Discussion and Analysis required by Item 402(b) of Regulation S-K and, based on such review, has recommended to the Board of Directors that the disclosure set forth under the heading "Compensation Discussion and Analysis" be included in this Proxy Statement and incorporated by reference into the Company's Annual Report on Form 10-K for the year ended December 31, 2016.

Submitted by the Compensation Committee:

Irving Greenblum, Douglas B. Howland, Peggy J. Newman and Larry Norton

Overview

In this section, we discuss certain aspects of our compensation program as it pertains to theour principal executive officer, Dennis E. Nixon, theour principal financialchief accounting officer, Imelda Navarro,Judith I. Wawroski, and the one other most highly-compensatedhighly‑compensated executive officer, David Guerra, in 2016.Julie L. Tarvin. We refer to these three persons throughout as the "executive“executive officers," "named” “named executive officers" or the "SEOs."officers.” The discussion focuses on compensation and practices relating to our most recently completed fiscal year.

Our management believes that the performance of each of the named executive officers has the potential to impact the Company's short-termCompany’s short‑term and long-termlong‑term profitability. Therefore, our management places considerable importance on the design and administration of the executive compensation program.

Generally, the compensation package for each of the named executive officers consists of base salary and the possibility of (i) an annual discretionary bonus, non-equity(ii) non‑equity incentive plan compensation, and (iii) a discretionary incentive stock option grant. Also, the named executive officers participate in the Employee'sEmployees’ Profit Sharing Plan and receive certain perquisites. Stock option grants are determined by the Company's Stock Option Plan

Committee as discussed above. Awards under the Company'sour MIP may be made by the Compensation Committee. Awards of $1,000,000, $1,000,000$1,250,000 and $1,000,000$1,250,000 were made by the Compensation Committee under the MIP to Mr. Nixon for services rendered to the Company during the 2014, 20152016, 2017 and 20162018 fiscal years, respectively. All cash compensation paid to our named executive officers of the Company is paid by IBC. Base salary levels and annual discretionary bonuses are recommended by the Compensation Committee upon recommendation of the Salary and Steering Committee of IBC. The Compensation Committee assists the Board of Directors in discharging its responsibilities relating to executive compensation. The Compensation Committee receives

recommendations from the Company'sCompany’s President regarding the compensation of the named executive officers (other than the President). Each member of the Compensation Committee serves as a director of both IBC and the Company and is independent under applicable Nasdaq Marketplace Rules.

The challenge for management and the Compensation Committee is to motivate, retain and reward key performers for working harder and smarter than ever in a difficult banking environment.

The Company'sCompany’s Incentive Compensation Policy was adopted on October 28, 2010 to address the Federal Reserve incentive compensation guidelines. Onguidelines, which were adopted on June 21, 2010, the Federal Reserve adopted final guidelines on incentive compensation which were substantially the same as those initially proposed on October 22, 2009.2010. The guidelines apply to all U.S. financial institutions. The guidanceinstitutions and includes three principles:

•Incentive compensation arrangements should balance risk and financial results in a manner that does not provide employees incentives to take excessive risks on behalf of the banking organization;

•A banking organization's risk-management processes and internal controls should reinforce and support the development and maintenance of balanced incentive compensation arrangements; and

•Banking organizations should have strong and effective corporate governance to help ensure sound compensation practices.

| · | | Incentive compensation arrangements should balance risk and financial results in a manner that does not provide employees incentives to take excessive risks on behalf of the banking organization; |

| · | | A banking organization’s risk‑management processes and internal controls should reinforce and support the development and maintenance of balanced incentive compensation arrangements; and |

| · | | Banking organizations should have strong and effective corporate governance to help ensure sound compensation practices. |

Compensation Philosophy

Our Company's compensation philosophy is to maximize long-termlong‑term return to shareholders consistent with the Company'sCompany’s commitments to maintain the safety and soundness of the institution and provide the highest possible level of service to theits customers and the communities that it serves. To do this, the Compensation Committee believes the Company must provide competitive salaries and appropriate incentives to achieve long-termlong‑term shareholder return.

Our Company's executive compensation policies are designed to achieve four primary objectives:

•attract and retain well-qualified executive leadership;

•provide incentives for achievement of corporate goals and individual performance;

•provide incentives for achievement of long-term shareholder return; and

•align the interests of management with those of the shareholders to encourage continuing growth in shareholder value.

| · | | attract and retain well‑qualified executive leadership; |

| · | | provide incentives for achievement of corporate goals and individual performance; |

| · | | provide incentives for achievement of long‑term shareholder return; and |

| · | | align the interests of management with those of the shareholders to encourage continuing growth in shareholder value. |

The Compensation Committee'sCommittee’s goal is to effectively balance salaries with other performance-basedperformance‑based compensation commensurate with an officer'sofficer’s individual management responsibilities and contribution to corporate objectives. Each of the three named executive officers has served the Company for over twenty-fivetwenty-two years. The salary and bonus decisions of the Compensation Committee are subjective and

focused on whether there is any compelling reason to deviate from the historical compensation pattern for each named executive officer. If not, it will be expected that the individual will receive a salary and bonus that is consistent with the historical compensation pattern for that individual. The determination of whether there is a compelling reason to deviate from the historical compensation pattern for ana named executive officer is based on whether there is a significant change in the trend of financial performance for the Company and whether there is an overall perception that the individual satisfactorily performed his or her duties at the Company. The historical compensation decisions of the Compensation Committee with respect to compensation of the named executive officers also reflect the Compensation Committee'sCommittee’s subjective assessment of the competitive nature of the markets where the Company does businessoperates and the difficulty in retaining qualified executive officers in such markets. The Compensation Committee takes these competitive salary factors into consideration when making its subjective salary and bonus compensation decisions for the named executive officers.

Decisions Regarding Executive Compensation

The Compensation Committee'sCommittee’s recommendations regarding each named executive officer'sofficer’s compensation are subjective with regard to both the base salary and discretionary bonus, non-equitynon‑equity incentive plan compensation and a discretionary incentive stock option grant. At the end of each year, a base salary recommendation for the next year and a discretionary bonus recommendation for the previous yearyear’s service are made for each named executive officer by the Compensation Committee. When proposing compensation levels, the Compensation Committee reviews, discusses and analyzes the historical compensation for each named executive officer of the Company and whether there is any compelling reason to deviate from such historical compensation pattern for each executive officer. Onlypattern. Generally, in the event that the Compensation Committee perceives that there will be a long-termlong‑term trend of negative overall performance of the Company, or in the event that ana named executive officer is perceived as not having satisfactorily performed his or her duties at the Company, will the cash compensation of ansuch named executive officer be expected to be negatively impacted. The Compensation Committee receives recommendations respecting such analysis from the Company'sCompany’s President (other than as it pertains to the President). Before a vote is taken, Committee members have an opportunity to ask for additional information, to raise and discuss further questions and to consult outside consultants and/or separate legal counsel. During 2016,2018, the Compensation Committee did not consult outside consultants or separate legal counsel. The Compensation Committee intends to consider the independence factors set forth in the Nasdaq Listing Rule 5605(d)(3) if the Compensation Committee decides to hire a compensation consultant, legal counsel or other compensation adviser in 2017.2019. All base salary and cash bonus recommendations of the Compensation Committee, other than awards under the MIP, are subject to final approval of the IBC Board of Directors of IBC.Directors.

Our Company's executive compensation program consists primarily of the following elements: (i) base salary and benefits; (ii) annual cash bonus incentives, (iii) non-equitynon‑equity incentive plan compensation, including possible awards under the Management Incentive Plan; (iv) longer-term equity-basedlonger‑term equity‑based incentives in the form of stock options; (v) participation in the Employees'Employees’ Profit Sharing Plan; and (vi) certain perquisites. In 2010, due to the Company'sCompany’s participation in the TARP program, the Companywe added an additional element to the Company'sour executive compensation program in the form of long-termlong‑term restricted stock units, but no long-termlong‑term restricted stock units were granted in 2016.2018. Each component of compensation is intended to accomplish one or more of the compensation objectives discussed above.

Base Salary and Benefits.Annual base salaries are set to attract and retain executive officers with exceptional abilities and talent. The Compensation Committee considers each named executive officer'sofficer’s performance, historical compensation and responsibilities within the Company. As stated above,noted, the salary decisions of the Compensation Committee are subjective and focused on whether there is any compelling reason to deviate from the historical compensation pattern for each named executive officer. If not, it will be

expected that the individual will receive a base salary that is consistent with the historical compensation pattern for that individual. The Compensation Committee also periodically collects salary information from other publicly-tradedpublicly‑traded bank holding companies in Texas. The Compensation Committee does not have targeted parameters with respect to the review of the salary information collected from such comparatorcomparative companies. Rather, the Compensation Committee collects the salary information for comparison as a means to identify major changes in the overall compensation levels of executive officers of publicly-tradedpublicly‑traded bank holding companies in Texas. Any such major change would be considered by the Compensation Committee in its determination of whether there is a compelling reason to deviate from the historical compensation pattern for any of the named executive officers. The Compensation Committee believes that the usefulness of the salary data of comparative companies is limited because the duties of officers with the same title may greatly differ from one company to another. In 2016,2018, the Compensation Committee collected and analyzed 20152017 salary information from Cullen/Frost Bankers, Inc., Prosperity Bancshares, Inc., Texas Capital Bancshares, Inc., and Valley National Bancorp. During 2016,2018, neither the Company nor the Compensation Committee retained the services of any compensation consultant.

Annual Cash Bonus Incentives.Annual cash bonus incentives are used to reward named executive officers for the Company'sCompany’s overall performance, taking into consideration individual performance. The discretionary bonus program is intended to compensate each named executive officer for the officer'sofficer’s contribution to the Company'sCompany’s (i) financial performance and (ii) other non-financialnon‑financial goals during the previous year. The Company did not pay a discretionary cash bonus to Mr. Nixon in 2016 for services rendered.2018. The other two named executive officers did receive cash bonuses as set forth in the Summary Compensation Table below.

As previously discussed, the bonus

Bonus decisions of the Compensation Committee are subjective and focused on whether there is any compelling reason to deviate from the historical compensation pattern for each named executive officer. If not, it will be expected that the individual will receive a bonus that is consistent with the historical compensation pattern for that individual. For each named executive officer other than the President, the President conducts a subjective analysis of each officer'sofficer’s individual performance and makes recommendations to the Compensation Committee as to the appropriate discretionary bonus amount, if any, taking into account each officer'ssuch officer’s historical compensation pattern. With respect to the analysis of individual performance, the President and Compensation Committee only determine whether there is a perception that the executive officer satisfactorily performed his or her duties at the Company. The Compensation Committee considers the recommendations of the President in determining the amount of the discretionary bonus for each named executive officer, other than the President. All decisions of the Compensation Committee with respect to executive compensation are subject to the final approval of the IBC Board of Directors of IBC.Directors.

In addition to considering an executive officer'sofficer’s historical compensation pattern and individual performance, the Compensation Committee also considers four measures of corporate performance in determining annual cash discretionary bonus amounts to be paid to the Company'snamed executive officers. These measures of performance are:

•earnings per share and earnings per share growth;

•return on average assets;

•return on average equity; and

•non-financial objectives.

| · | | earnings per share and earnings per share growth; |

| · | | return on average assets; |

| · | | return on average equity; and |

| · | | non‑financial objectives. |

During 2016, the Company2018, we did not have specific performance targets, thresholds or goals for any of the foregoing measures. Each measure is analyzed by the Compensation Committee to determine how it compares to the historical performance of the Company. Even if the performance in a category is not as favorable as the historical performance of the Company in such category, the Compensation Committee will subjectively analyze the reason for the difference and whether the Company believes it will cause a long-termlong‑term trend of negative overall performance of the Company. The Compensation Committee is focused on the long-termlong‑term results of the Company and recognizes that there may be periods when certain

non-financial non‑financial objectives may out-weigh near-termout‑weigh near‑term financial performance. The Compensation Committee believes that the total compensation paid to each of the named executive officers in 20162018 was appropriate in light of the compensation objectives of the Company.

Management Incentive Plan.During 2013, the Company adopted the MIP, which iswas designed to enable certain incentive awards to be deductible to the Company under Internal Revenue Code Section 162(m). In February 2016,2018, the Compensation Committee established performance goals and targets under the MIP that the Company would be required to meet or exceed for the 20162018 fiscal year, which were either one of the following ratios: (1) a .90% return on average total assets or (2) a 8% return on average total shareholders'shareholders’ equity. In February 2017,2019, the Compensation Committee confirmed that at least one of the 20162018 performance targetsgoals was met and the Compensation Committee awarded $1,000,000$1,250,000 to Mr. Nixon for services rendered during fiscal year 2016.2018. In February 2017,2019, the Compensation Committee established the performance targetsgoals under the MIP for fiscal year 2017,2019, which are either one of the following ratios: (1) a .90% return on the average total assets or (2) an 8% return on the average total shareholders'shareholders’ equity. The Compensation Committee also selected Mr. Nixon as the only eligible participant under the MIP to receive an award for the 20172019 fiscal year.

For services rendered to the Company in 2016,2018, Mr. Nixon received a salary of $660,000. The amount of Mr. Nixon'sNixon’s salary was consistent with the historical salary compensation pattern for Mr. Nixon, who has served as President of the Company and its predecessor, IBC, since 1975 and whose duties are more extensive than those of the other named executive officers.

Longer-Term Equity-Based Incentive-StockLonger‑Term Equity‑Based Incentive‑Stock Options.A portion of executive compensation is also linked to corporate performance through equity-basedequity‑based compensation awards in the form of stock options under the 2012 International Bancshares Corporation Stock Option Plan, or Stock Option Plan. Awards under the Company's shareholder-approvedCompany’s shareholder‑approved Stock Option Plan are designed to:

•align executive officer and shareholder interests;

•reward officers for building shareholder value; and

•encourage long-term investment in the Company by executive officers.

| · | | align executive officer and shareholder interests; |

| · | | reward officers for building shareholder value; and |

| · | | encourage long‑term investment in the Company by its executive officers. |

Although our Company has no specific stock ownership guidelines, the Compensation Committee believes that stock ownership by management is beneficial to shareholders and stock options have been granted by the Company to executive officers and key salaried employees pursuant to various shareholder-approvedshareholder‑approved stock option plans for many years. The size of the option grants is determined by the Stock Option Plan Committee based upon a subjective assessment of the respective employee'semployee’s performance, compensation level and other subjective factors determined by the Stock Option Plan Committee.

All stock option grants to executive officers have been made pursuant to shareholder-approvedshareholder‑approved stock option plans. The Stock Option Plan Committee administers all aspects of the Stock Option Plan and also has authority to determine the individuals to whom and the terms upon which options are granted, the number of shares subject to each option and the form of consideration payable upon the exercise of an option. The President makes recommendations of stock option grants (other than for himself), which the Stock Option Plan Committee then considers. The Stock Option Plan Committee takes final action on the amount, timing, price and other terms of all options granted to executive officers and key salaried employees of the Company. The exercise price of each option granted under the Stock Option Plan equaled the fair market value of the Common Stock as of the date of grant.

The Stock Option Plan Committee did not make anymade awards in the form of stock options to anytwo of the named executive officer; but did make awardsofficers and to several key employees in 2016.during 2018. The Stock Option Plan Committee has no formal policy as to timing of awards of stock options other than as set forth below with respect to the release of material non-publicnon‑public information. The size of the stock option grants are determined by the Stock Option Plan Committee based upon a subjective assessment of the respective

employee's employee’s performance, compensation level and other factors. Historically, the Company has not granted stock options to the named executive officers every year. Ms. Navarro was granted stock options in 2014 and 2015 and Mr. Guerra was granted stock options in 2014. The President has not received any stock option awards since 1997. The Company believes it is important to award the available stock options to other key employees of the Company in order to encourage long-termlong‑term investment in the Company by such key employees.

All stock option awards under the Stock Option Plan have been made at the fair market value of the our Common Stock on the date of grant. Stock options granted under the Stock Option Plan are generally granted for a term of eight or ten years and have a six or seven year vesting schedule. Stock options granted under the Stock Option Plan become exercisable generally over a six or seven year vesting period, vesting 5% after the first or second anniversary, and 10%, 15%, 20%, 25% and 25% each respective year thereafter and expire eight or ten years from the date of grant. The Stock Option Plan permits the exercise price to be paid by delivery of cash or by surrendering shares of our Common Stock. Vesting of certain stock options may be accelerated upon certain events, including a change in control of the Company. The President of the Company does not have any stock options that would be accelerated upon a change in control of the Company. Approximately thirtytwenty‑five percent of all stock options outstanding and held by named executive officers as of December 31, 20162018 were vested.

The Stock Option Plan is a tandem plan that provides for the granting of non-statutorynon‑statutory stock options and incentive stock options. No adjustment to the option price of the stock options is permissible if the adjustment would cause the options to become subject to Section 409A of the Code. The most recent stock options granted to named executive officers in 2014 and 2015 were all incentive stock options.Internal Revenue Code or the “Code.” The Stock Option Plan Committee believes that its decision to not grant any incentive stock options in 20162018 to named executive officers is consistent with the Company'sCompany’s compensation objectives.

Long Term Restricted Stock Unit Plan.In 2009, the Board of Directors adopted the 2009 International Bancshares Corporation Long-TermLong‑Term Restricted Stock Unit Plan, or LTRSU Plan, to give the Company additional flexibility in the compensation of its officers, employees, consultants and advisors in compliance with all applicable laws and restrictions. The LTRSU Plan provided for both the issuance of long-termlong‑term restricted stock units that complied with the compensation restrictions under the TARP program, as well as long-termlong‑term restricted stock units that did not comply with such restrictions. Long-termLong‑term restricted stock units issuable under the LTRSU Plan are not equity and are payable only in cash. One of our named executive officers, Dennis E. Nixon, received awards of long-termlong‑term restricted stock units, or RSUs, that complied with the TARP compensation restrictions. The Company did not issue any RSUs during 2014, 20152016, 2017 or 2016,2018, and does not have any RSUs outstanding at this time. The Company does not intend to award any RSUs during 20172019 or in the foreseeable future.

Profit Sharing Plan.The Company has a 401(k) deferred profit sharing plan for eligible employees in order to provide a tax-advantagedtax‑advantaged savings vehicle to employees. It is a tax-qualified,tax‑qualified, defined contribution plan. The Company'sCompany’s annual contribution to the profit sharing plan is based on a percentage, as determined by the Board of Directors, of total compensation paid during the year to participants of the profit sharing plan. Allocation of the contribution among officers and employees'employees’ accounts is based on length of service and amount of salary earned. Profit sharing costs of $3,650,000$3,850,000 were charged to income for the year ended December 31, 2016.2018. This profit sharing plan and the Company'sCompany’s contribution to the plan enhance the range of benefits the Company offers to executives and employees and enhances the Company'sCompany’s ability to attract and retain qualified employees.